The Sixteenth Amendment to the United States Constitution allows the Congress to "lay and collect taxes on incomes, from whatever source derived".

Far-reaching in its social as well as its economic impact, the income tax amendment became part of the Constitution by a curious series of events culminating in a bit of political maneuvering that went awry.

Contents

Background[edit]

Civil War[edit]

The financial requirements of the American Civil War prompted the first American income tax in 1861. At first, Congress placed a flat 3-percent tax on all incomes over $800 and later modified this principle to include a graduated tax. Congress repealed the income tax in 1872, but the concept did not disappear.

Post Civil War[edit]

After the Civil War, the growing industrial and financial markets of the eastern United States generally prospered. But the farmers of the south and west suffered from low prices for their farm products, while they were forced to pay high prices for manufactured goods. Throughout the 1860s, 1870s, and 1880s, farmers formed such political organizations as the Grange, the Greenback Party, the National Farmers’ Alliance, and the People's (Populist) Party. All of these groups advocated many reforms (see the Interstate Commerce Act) considered radical for the times, including a graduated income tax.

Progressive Era[edit]

In 1894, as part of the Wilson-Gorman Tariff bill, Congress enacted a 2-percent tax on income over $4,000. The tax in 1895 was struck down by a five-to-four decision of the U.S. Supreme Court in Pollock v. Farmers' Loan & Trust Co. It held unconstitutional any direct tax by Congress on income. A tax on income derived from property was a direct tax which Congress could impose only by the rule of apportionment according to population pursuant to Article I, Secs. 2 and 9 of the Constitution. The Pollock decision was a surprise because merely 15 years earlier the Supreme Court had unanimously upheld a similar tax during the Civil War, the only other time that Congress had tried to tax income directly.

Although radicals denounced the Court's decision as a prime example of the alliance of government and business against the farmer, a general return of prosperity around the turn of the century softened the demand for reform. Democratic Party Platforms under the leadership of three-time Presidential candidate William Jennings Bryan, however, consistently included an income tax plank, and the progressive wing of the Republican Party also espoused the concept.

After Pollock, the Court did uphold creative taxation by Congress based on a theory that they were levied on mere "incidents of ownership" and thus were constitutional excise taxes: (1) an inheritance tax, (2) a tax affixing revenue stamps to memoranda for the sale of merchandise on commodity exchanges, (3) a war revenue tax upon tobacco being resold, and (4) a corporate income tax as an excise "measured by income" justified by the privilege of doing business in corporate form.

Comeback[edit]

The income tax, long a dream of progressives, was put on the back burner until a later date and more opportune time to try again. As a few years went by, the popularity of taxing income gradually increased once more, and even was included as a topic in the 1907 State of the Union address of then president Theodore Roosevelt.[1]

Passage[edit]

In 1909 progressives in Congress, led by Republican Senator Nelson Aldrich, Republican of Rhode Island, proposed a constitutional amendment allowing an income tax. President William Howard Taft gave an important speech in support of the effort on June 16, 1909.[2] Shortly thereafter, a resolution proposing the 16th amendment was submitted on July 12, 1909.[3] The amendment was ratified by one state legislature after another, and on February 25, 1913, with the certification by Secretary of State Philander C. Knox, the 16th amendment took effect. The first income tax was passed in 1913 as part of the Underwood Tariff. Since the new tariff was lower, the government needed a way to replace the lost revenue. Due to generous exemptions and deductions, less than 1 percent of the population paid income taxes at the rate of only 1 percent of net income. However, during World War I the heavy cost of the war led to much higher rates; the rates were lowered in the 1920s.

The Sixteenth Amendment settled the constitutional question of permission to tax income and, by so doing, effected dramatic changes in the American way of life. The states which ratified the amendment are as follows:[4]

- Alabama, August 17, 1909

- Kentucky, February 8, 1910

- South Carolina, February 23, 1910

- Illinois, March 1, 1910

- Mississippi, March 11, 1910

- Oklahoma, March 14, 1910

- Maryland, April 8, 1910

- Georgia, August 3, 1910

- Texas, August 17, 1910

- Ohio, January 19, 1911

- Idaho, January 20, 1911

- Oregon, January 23, 1911

- Washington, January 26, 1911

- California, January 31, 1911

- Montana, January 31, 1911

- Indiana, February 6, 1911

- Nevada, February 8, 1911

- Nebraska, February 11, 1911

- North Carolina, February 11, 1911

- Colorado, February 20, 1911

- North Dakota, February 21, 1911

- Michigan, February 23, 1911

- Iowa, February 27, 1911

- Kansas, March 6, 1911

- Missouri, March 16, 1911

- Maine, March 31, 1911

- Tennessee, April 11, 1911

- Arkansas, April 22, 1911

- Wisconsin, May 26, 1911

- New York, July 12, 1911

- South Dakota, February 3, 1912

- Arizona, April 9, 1912

- Minnesota, June 12, 1912

- Louisiana, July 1, 1912

- Delaware, February 3, 1913

- Wyoming, February 3, 1913

- New Jersey, February 5, 1913

- New Mexico, February 5, 1913

Three states rejected this amendment:

- Connecticut, September 27, 1911

- Rhode Island, April 29, 1910

- Utah, March 9, 1911

The remaining states ratified this amendment, after the necessary number was reached: Vermont, Massachusetts, New Hampshire, and West Virginia.

Repeal efforts[edit]

On April 13, 2000, an organization called We the People Foundation for Constitutional Education, Inc. sent delegates to Washington D.C. to argue that the 16th Amendment was not properly ratified. There are a number of questionable circumstances surrounding the ratification, including evidence that states which were claimed to have ratified it actually rejected it.

Text of the Congressional Resolution and the Sixteenth Amendment[edit]

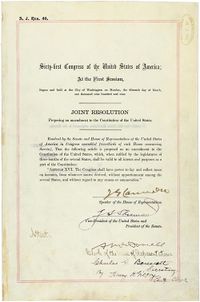

Sixty-first Congress of the United States of America, At the First Session,

Begun and held at the City of Washington on Monday, the fifteenth day of March, one thousand nine hundred and nine.

JOINT RESOLUTION Proposing an amendment to the Constitution of the United States.

Resolved by the Senate and House of Representatives of the United States of America in Congress assembled (two-thirds of each House concurring therein), That the following article is proposed as an amendment to the Constitution of the United States, which, when ratified by the legislature of three-fourths of the several States, shall be valid to all intents and purposes as a part of the Constitution:

- "ARTICLE XVI. The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

References[edit]

- ↑ State of the Union 1907 - 3 December 1907, Quote: "When our tax laws are revised the question of an income tax and an inheritance tax should receive the careful attention of our legislators. In my judgment both of these taxes should be part of our system of Federal taxation."

- ↑ William Howard Taft, Special Message To the Senate and House of Representatives

- ↑ United States Congressional serial set, Issue 6773

- ↑ United States Congressional serial set, Issue 6773

Amendments to the Constitution of the United States of America Bill of Rights:

1 - Freedom of speech, press, religion, etc.

2 - Right to bear arms

3 - Quartering of soldiers

4 - Warrants

5 - Due process

6 - Right to a speedy trial

7 - Right by trial of a jury

8 - No cruel or unusual punishments

9 - Unenumerated rights

10 - Power to the people and states

11 - Immunity of states to foreign suits

12 - Revision of presidential election procedures

13 - Abolition of slavery

14 - Citizenship

15 - Racial suffrage

16 - Federal income tax

17 - Direct election of the United States Senate

18 - Prohibition of alcohol

19 - Women's suffrage

20 - Terms of the presidency

21 - Repeal of Eighteenth Amendment

22 - Limits the president to two terms

23 - District of Columbia Voting for President

24 - Prohibition of poll taxes

25 - Presidential disabilities

26 - Voting age lowered to 18

27 - Variance of congressional compensation